Financing an ADU in the past has been difficult.

Legacy Build has solved that issue

Get lower rates based on the future value AFTER the build.

Instantly add equity, and have the ability to pay off with no pre payment penalty.

Multiple options between home equity line, and secondary fixed loan.

Financial Flexibility for your Construction Project

At Legacybuild Construction, we know that building an ADU is a big investment—and we're here to make the process easier. We offer flexible financing options to help bring your vision to life without the financial stress. Let’s build something great, together.

Benefits of our financial solutions:

Loan rates tailored for construction, remodel and ADU build.

Assistance and guidance with financing applications and approvals.

Transparent terms with no hidden costs & no additional fees.

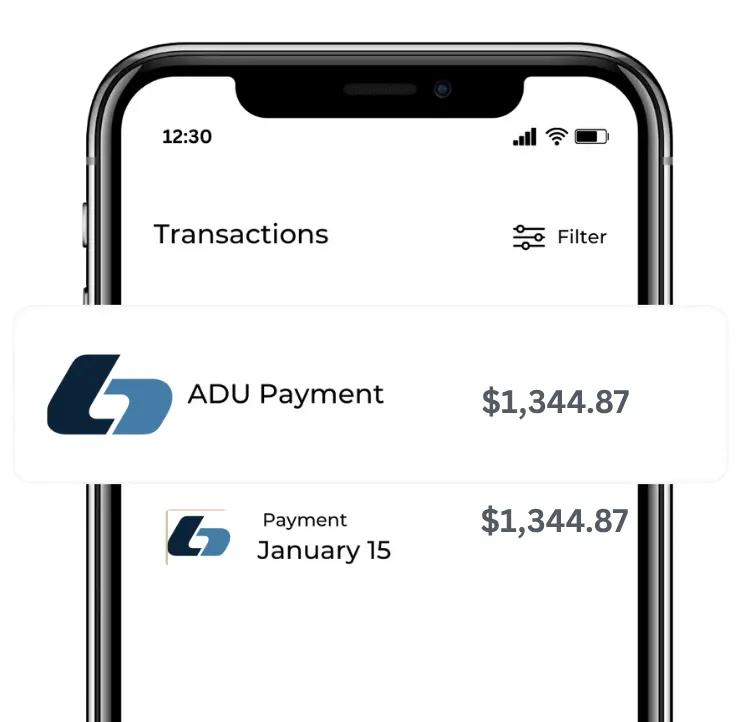

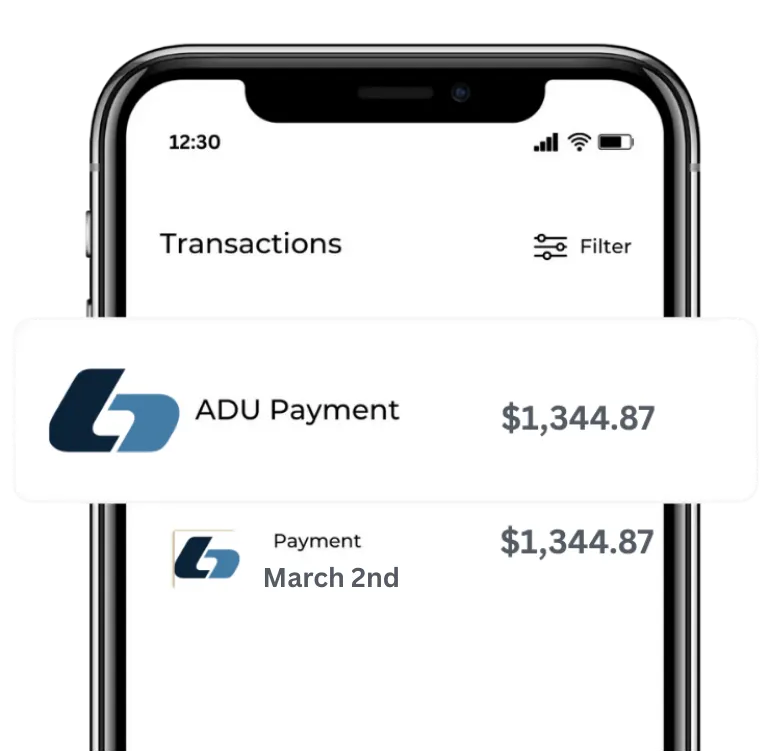

What you could pay:*

Other Financing Options

$2570 /mo

for 30 years

9.5% APR +

30 year term.

Legacybuild construction

$1,350 /mo

for 30 years

Financing with Legacybuild Construction

7% APR

30 year term.

Building an ADU Doesn’t Have to Break the Bank!

At Legacybuild, we’re here to help you unlock the full potential of your property with a high-quality, affordable ADU. Every project is unique, so we offer transparent, tailored pricing based on your design, materials, and site conditions—no guesswork, no surprises. Our team works closely with you to create a realistic, budget-conscious plan without cutting corners on craftsmanship or design. With clear communication from day one, you’ll always know what to expect.

Let’s bring your vision to life—your ADU dream is closer than you think.

Financial Flexibility for Your ADU Project

HELOC

A HELOC (Home Equity Line of Credit) is a type of second mortgage that lets you keep your current mortgage unchanged. It’s a popular option for ADU projects because it allows you to borrow against your home’s equity as needed. Payments are typically based on your current balance—similar to a credit card, but with much lower interest rates. This flexible payment structure can help keep your costs lower during the construction phase.

Heloan

This is also a second mortgage, but it works differently from a HELOC. With this option, you receive the full loan amount upfront. It typically comes with a fixed interest rate and a repayment term of 20 years or less. Monthly payments of both principal and interest begin right away, since the full funds are deposited into your account at the start.

Renovation loans

These loan options allow the future value of your ADU to be considered when calculating your home’s equity. They can come in the form of a cash-out refinance, HELOC, or home equity loan (HELoan).

Cash-out Refinance

This type of loan is ideal if you have significant equity in your home and your current interest rate is close to today’s market rates. It’s a first mortgage product, meaning it replaces your existing mortgage entirely. It’s also commonly used when a home is fully paid off—or nearly paid off—with no existing mortgage.

Construction Loans

This is a first mortgage loan that replaces your current mortgage with one based on today’s interest rates. It’s especially useful for properties with no existing structures.

Personal loan

This option is typically used for smaller projects (under $100K) or to cover the difference when there isn’t enough equity in the home to fund the entire project.

Copyright © 2025 Legacybuild Construction | All Rights Reserved